By Jorge Costa Oliveira

Partner and CEO of JCO Consultancy

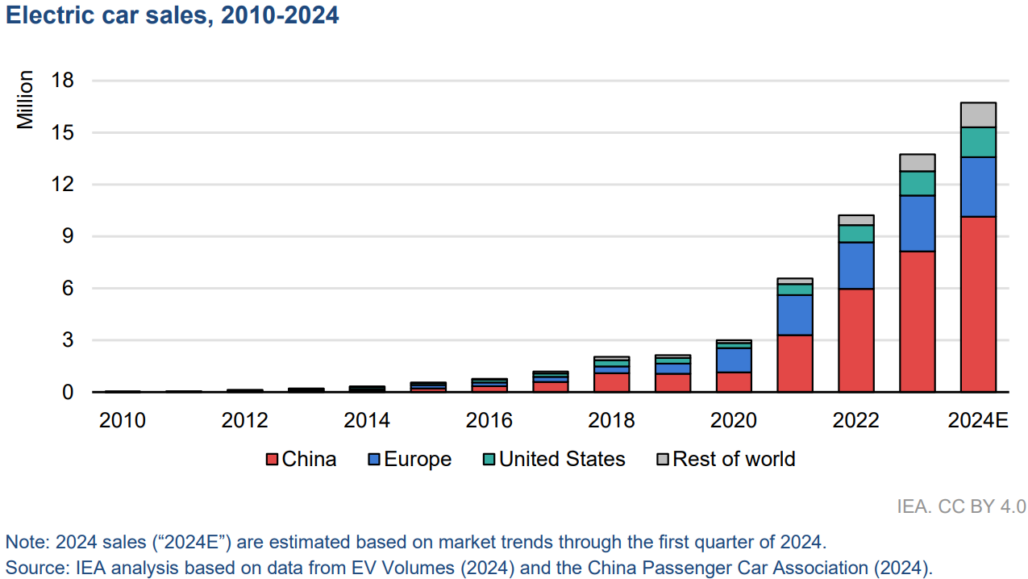

Well-defined public policies (including significant government incentives – purchase subsidies, tax incentives and favourable licensing plates), good government and business planning in creating an integrated value chain in the electric storage and mobility sectors, and the absence of entropies created by radical environmentalist activism, all these factors converged to make China the largest market in the production (45%) and consumption (60%) of electric vehicles (EV). It should be noted that it is not only Chinese brands (BYD, Great Wall, SAIC, BAIC, Changan, Chery, Geely, XPeng, NIO) that produce EV in China; many foreign brands (Tesla, Ford, GM, BMW, VW, Mercedes, Audi, Renault, Volvo, Jaguar Land Rover, Nissan) also have EV plants within China, producing for the Chinese domestic market, but also for export. Value chain integration – from the refining of critical metals to the production of electric cells, cathodes, anodes, to gigafactories and EV assemblers – low production costs, the abovementioned government incentives and effective competition, have enabled the production of EVs in China to be significantly cheaper than in the US and Europe. According to some industry experts, production in China can shave up to €10,000 off the cost of an EV. In 2022, electric battery prices were 24% lower in China than in the U.S.

Meanwhile, in the Chinese domestic EV market, demand growth is slowing down (+90% in 2022, +36% in 2023, +22% in 2024) and competition is fierce (with a price war that has lasted for more than a year). Furthermore, several western institutions consider that China’s EV industry is at overcapacity, producing annually an excess of 5 to 10 million EVs beyond domestic demand, forcing China to find new markets to fuel continued growth.

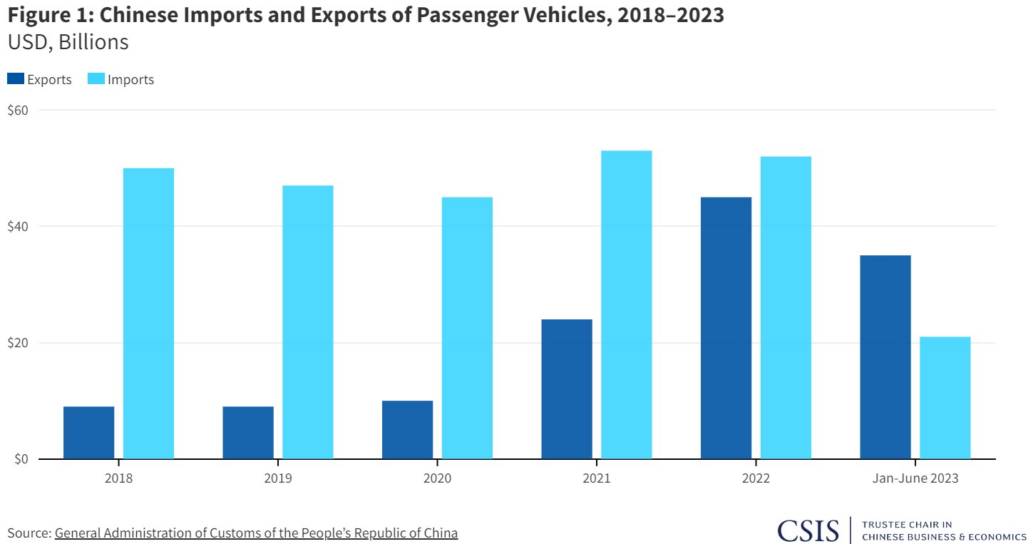

Internationalisation has become an essential facet for all EV producers in China, focused on key potential consumer markets. Thus far, the internationalisation of Chinese EVs has been made mainly via exports. The growth of EV exports was the key factor for China’s reversion of its automotive trade balance; since mid-2022, vehicle exports have continuously outperformed imports. This trend was catalysed by China-produced vehicle exports to Russia amid the retreat of western corporations from this market since Ukraine’s invasion.

Overall, the Association of European Vehicle Logistics (ECG), citing data from the China Association of Automobile Manufacturers (Caam), reports that Chinese [all] vehicle exports rose >1.3m in Q1 2024 (76.8% ICE, 23.2% NEVs), up 33% from Q1 2023, with leading markets being Russia (112,000 units), Mexico (66,000), Belgium (42,000) and the UK (38,000). The main Chinese carmakers exporters were Chery (with 253,000 units), SAIC (206,000), Changan (145,000), Geely (111,000), BYD (99,000), Great Wall (93,000) and Tesla (88,000).

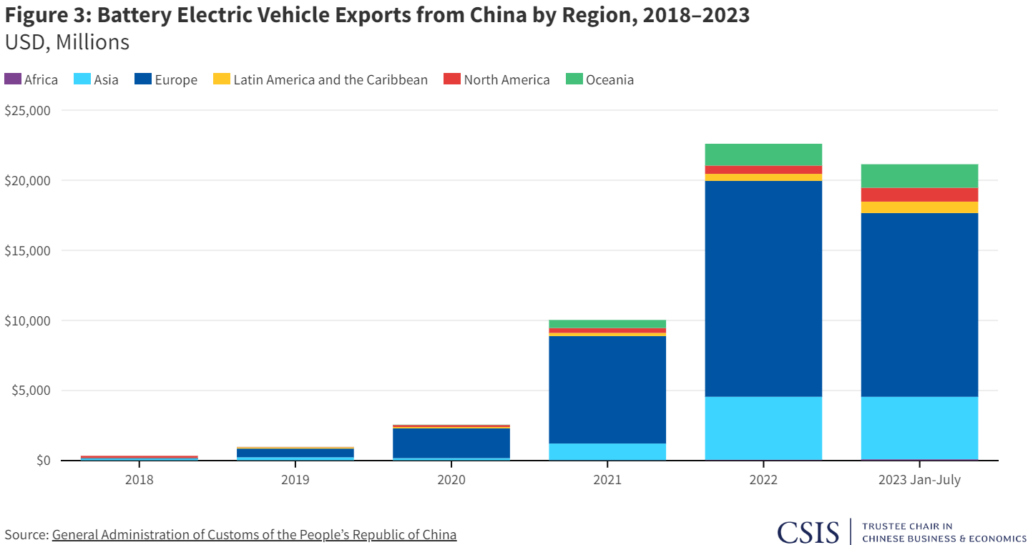

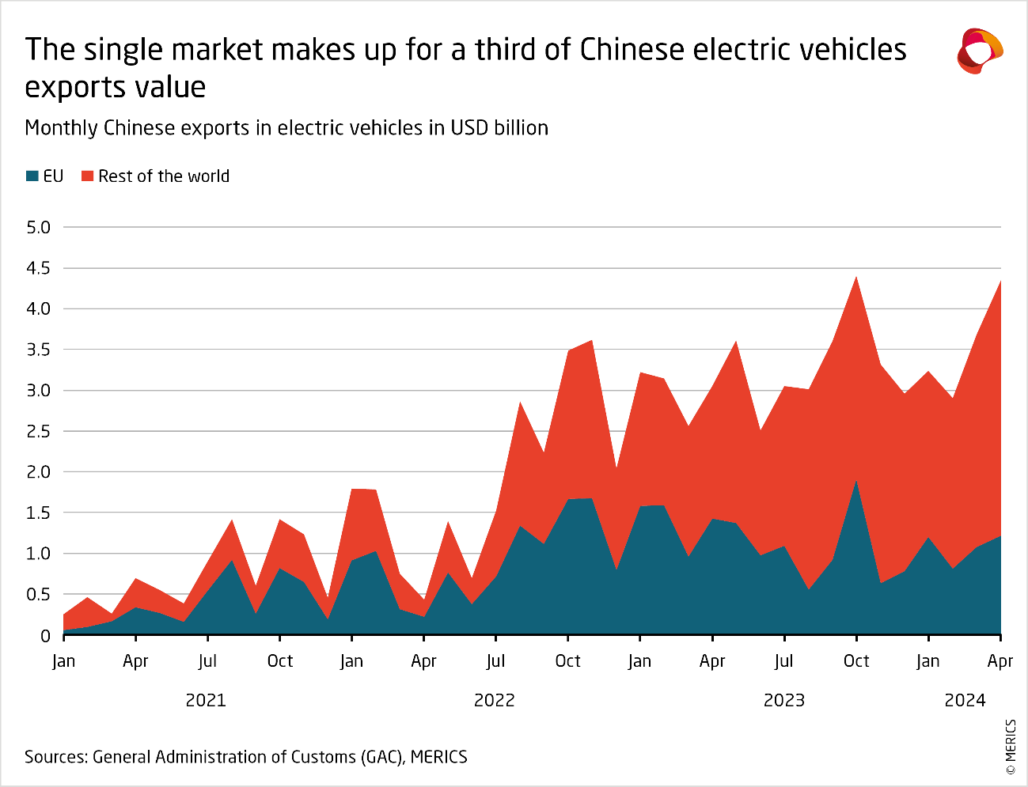

The main destination market for Chinese-produced EVs is Europe, followed by Asia; there is little penetration in the North American and Latin American markets (although growing fast in Brazil). Chinese EV brands avoid exporting to the US, which has a 27.5% tariff on automobiles imported from China (soon to be increased to 100%) and tie EV tax credits to local incorporation requirements. The majority of EVs exported from China are destined for Europe due to high demand in the region, high European per capita income, high local EV prices, low European customs tariffs, and substantial government subsidies for EVs, regardless of its origin.

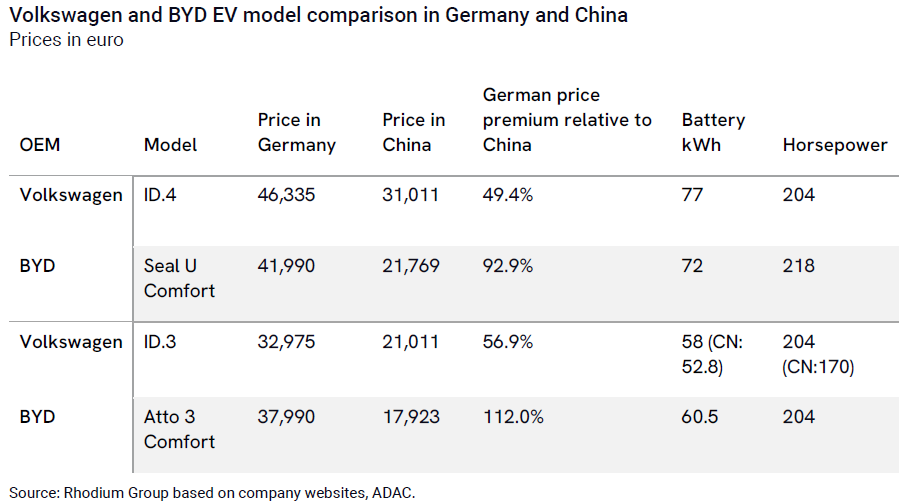

To understand the competitiveness of Chinese EV brands, a recent report by Rhodium Group gives the example of BYD’s Seal U model that sells for €21,770 in China and €41,990 in the EU. Not only are Chinese automakers rapidly gaining shares of the European EV market (especially in the lower-priced segments), but they are making higher profits in Europe. Elon Musk’s prediction that Chinese carmakers would ‘demolish’ global rivals is coming true in literally every market (hence the 100% tariff imposed by the US government).

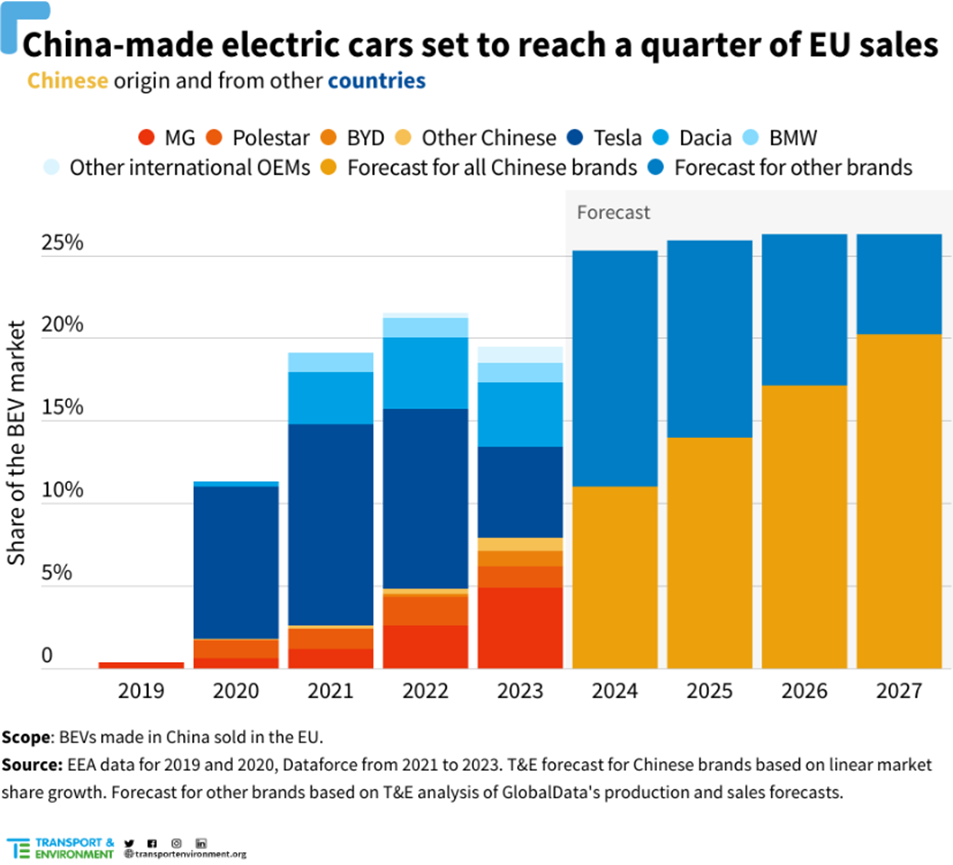

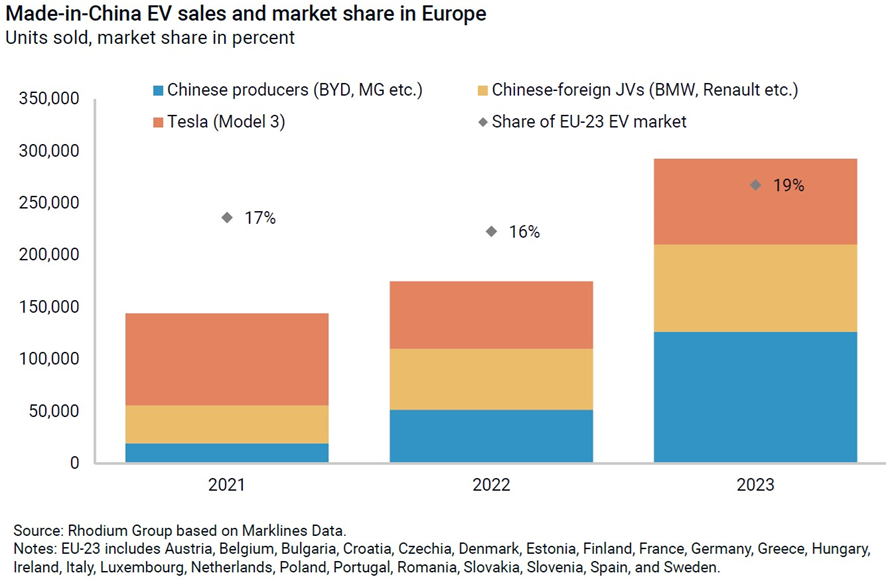

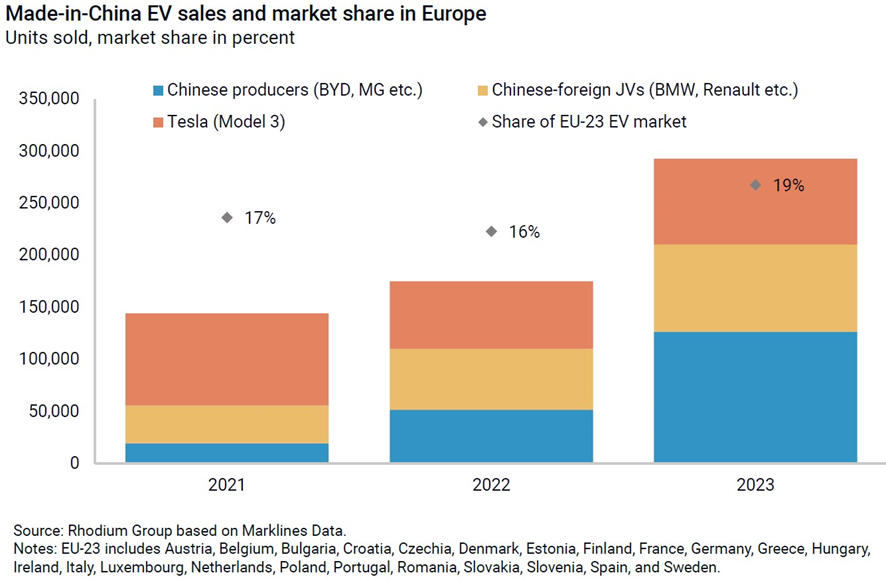

According to the European Automobile Manufacturers’ Association (ACEA), China maintained its position as the leading source of new car imports to the EU in terms of value, with a growth of 37.1% and a market share of 17.7%. A significant portion of this growth is due to EVs. According to the European Federation for Transport and Environment (T&E), EVs manufactured in China are expected to account for 25% of total EV sales in Europe in 2024 (+5% compared to 2023).

T&E projections estimate that [among the EVs manufactured in China] Chinese brands will progressively gain bigger market shares – 11% by 2024 and 20% until 2027. However, it is important to clarify what “Chinese brands” means. In 2023, Chinese brands only represented a 2.5% market share of the European market last year, with 72% of that share belonging to MG, a British car brand controlled by the Chinese group SAIC Motor, MG being today a fully Chinese brand from production to design. Without MG, Chinese brands have only a 0.6% market share in Europe. This discrepancy arises from the fact that most vehicles imported from China to Europe are not Chinese brand vehicles but rather vehicles manufactured in China by foreign brands. Tesla alone accounts for 68% of the EVs imported from China and registered in Western Europe.

Following an investigation launched by the European Commission on “unfair subsidization” of China-produced EVs’, the currently low EU customs tariffs (10%) are going to be increased to up to 38% (on BYD: 17,4%; on Geely: 20%; on SAIC: 38,1%; on other BEV producers in China, which cooperated in the investigation but have not been sampled: 21%; on all other BEV producers in China which did not cooperate in the investigation: 38,1%). It is not clear the effect that such an increase will have on European consumers demand for China-produced EVs, but it is likely to slow down the [fast] penetration they were having.

Given the high tariffs already imposed in many relevant markets (e.g., India, Thailand, Brazil) to protect local automobile industries and the high probability that the EU would raise its tariffs (and eventually impose non-tariff obstacles), Chinese EV producers have planned to and are gradually setting up plants in several countries outside China.

Journey to the West – the European Market

The growing decoupling between China and the US has refrained Chinese EV producers from venturing into US-based production. Only Polestar – a luxury EV brand owned by Geely – has an investment in an EV plant, scheduled to start production in South Carolina in 2024 (it is so far the only brand selling in the US China-produced EVs).

The main market where Chinese-branded EV companies plan to set up plants is Europe. BYD will have its first European plant investment in Hungary, and announced it is considering a second European plant in 2025. It is also likely that Great Wall Motors will make its first European plant in Hungary (negotiations concerning government incentives, including tax breaks, to attract foreign investment and for job creation, are under way). These investments are in line with sizable investments (and government incentives) for gigafactories in the country, to be made by South Korean groups SK On and Samsung SDI and Chinese battery giant CATL.

Spain, Europe’s second largest car-making country after Germany, has secured investment from Chery, which will start production in the fourth quarter at a former Nissan facility in Barcelona, via a partnership with Spanish EV Motors. Chery is expected to benefit from Spain’s 3.7 billion-euro programme launched in 2020 to attract EV and battery plants.

China’s Envision Group has already received 300 million euros in incentives under the scheme for a 2.5 billion battery plant creating 3,000 jobs. Spain might also host Stellantis’ planned fourth gigafactory in Europe, with CATL.

Poland will have an EV plant to be made, in Tychy, by a partnership of China’s Leapmotor and Franco-Italian Stellantis.

Chery is mulling over plans to establish a plant in the UK as it begins to launch its Omoda and Jaecoo brands, following in the footsteps of several Chinese-owned gigafactories producing electric batteries in the country.

According to Reuters, Chery plans a second, larger facility in Europe, a source with knowledge of the company’s plans told, and has held talks with governments, including the Italian one, which is keen to attract a second automaker to rival Fiat-maker Stellantis.

Italy can tap its national automotive fund, worth 6 billion euros between 2025 and 2030, for incentives for both car buyers and manufacturers. China’s Dongfeng is among several other automakers that have held investment discussions with Rome.

Still, according to Reuters, SAIC, owner of the MG brand, aims to build two Europe plants. The first, based at an existing facility, could be announced as early as July and would employ a kit-assembly technique, targeting annual production of up to 50,000 vehicles. SAIC’s second European plant would be completely greenfield and produce up to 200,000 vehicles annually. Germany, Italy, Spain and Hungary are reported to be on SAIC’s location shortlist.

BYD, Chery, SAIC and Great Wall are also looking for attractive locations in Eastern Europe and Turkey (its Association Agreement with the EU creates a customs union, and the country has several free trade agreements with non-EU countries) to set up plants for lower-cost vehicles.

Turkey is reported to be in advanced negotiations with BYD and Chery for EV plants investments in the country. The Turkish government says that separate negotiations are also underway with SAIC Motor, which owns MG, and Great Wall Motor.

Overcoming shipping issues

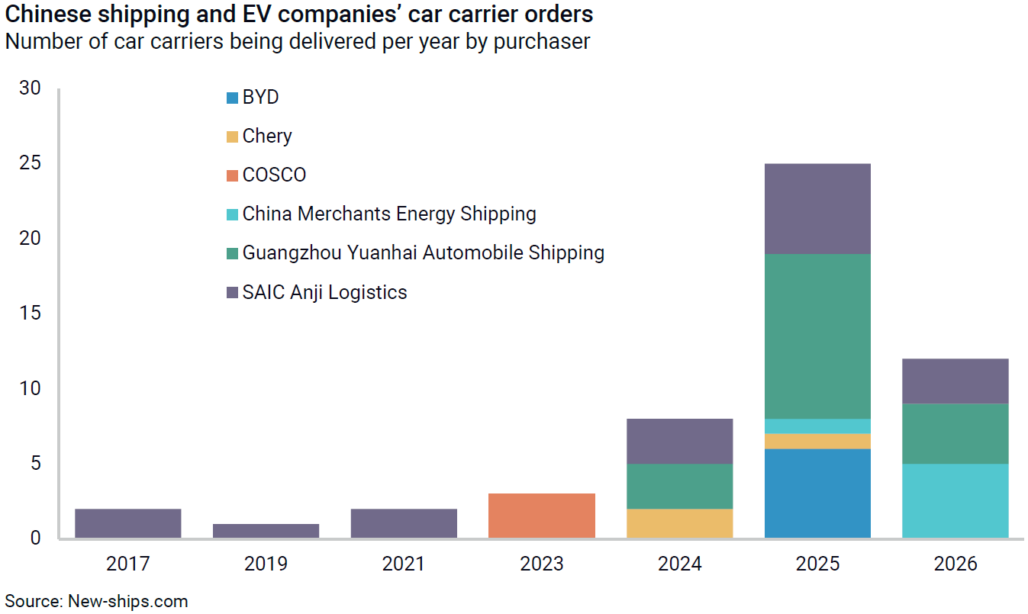

In 2023, prices for car shipping carriers increased by up to 700% compared to 2019; Houthi attacks in the Red Sea further exacerbated them. A perception of shortage of shipping carriers [capacity] and inflated costs stemming from the war in Ukraine led Chinese EV carmakers and associated shipping companies to place orders for a significant number of new car carrier ships. According to the abovementioned report by the Rhodium Group, the combined capacity of these ships will allow the shipment of an estimated 560,000 cars annually to Europe in 2025, based on six trips a year (in 2023 the EU imported 472,000 EVs from China). Said capacity could surge to 1.7 million cars in 2026. “In the unlikely case that all ships were used for transporting cars to Europe, the volumes exported from China would likely be enough to capture 50% of the EU’s EV market”. The decision to purchase rather than lease these car-shipping carriers shows the long-term commitment of Chinese EV producers to export large quantities of cars.

Journey to SE Asia

The other relevant market where Chinese-branded EV companies plan to set up plants is Southeast Asia.

According to a Counterpoint analyst, “over 70% of EV sales in [Southeast Asia] are from Chinese brands, led by BYD”. Thailand is the main destination market in SE Asia, accounting for 79% of ASEAN EV sales. Several major Chinese EV manufacturers have already established or announced plans to invest in Thailand. Great Wall Motors operates an EVs plant in Rayong province that produces its Ora brand. The company also plans to build a battery factory and an R&D centre in Thailand. BYD (in cooperation with Rever Automotive) also has a plant in Rayong that produces EVs and batteries. Chongqing Changan Automobile intends to invest 10 billion baht ($290 million) to set up an EV production facility in Chonburi province. The company expects to start production in 2024 and sell its vehicles under the Kaicene brand. GAC Aion plans to invest 6.2 billion baht ($180 million) to build an EV plant in Chachoengsao province. The company targets to begin production in 2024 and launch its Aion V model in Thailand. Hozon New Energy Automobile (in partnership with a local firm, Yontrakit Group) will start production of its Neta brand of EVs in Thailand in 2024. In 2023, SAIC Motor, in cooperation with Charoen Pokphand Group (CP), opened its first battery plant for EV in Chonburi province. SAIC Motor-CP said it intended to start making MG BEVs in Thailand.

Several Chinese EV brands are also scheduled to be produced in Malaysia. Hozon New Energy Automobile announced investments to produce the Neta brand in Malaysia. Changan Automobile Corporation (in partnership with Fieldman EV Sdn Bhd (FEV)) plans to build the Eado EV460 model in Lipat Kajang, Jasin, Melaka. Chery also plans to produce its EQ1 model in Malaysia. BYD (in partnership with CSH Alliance) will assemble (CKD) the BYD T3 electric van in Tanjung Malim, Perak.

Even in Vietnam, home to the successful VinFast EV carmaker, BYD and Haima announced plans to build plants to produce car parts and plants to assemble EVs.

In Indonesia (by far the most populous SE Asian country, but with a low GDP per capita), PT Neta Auto (a subsidiary of Chinese firm Hozon Auto), in partnership with PT Handal Indonesia Motor (HIM), has started the production of Neta’s latest model, the Neta V-II (on a CKD basis) in Bekasi, West Java. Neta V-II is powered by LFP batteries from Chinese battery maker Gotion High-tech, a battery pack that, according to Neta Auto, has 44% of its components produced in Indonesia. BYD announced in January 2024 that it will make an EV plant in Indonesia, following a previous intention of building an electric bus assembly plant and, eventually, a battery manufacturing factory in Indonesia. Chinese EV maker Aion announced in April 2024 that plans to make an EV plant in Indonesia (in partnership with Indomobil Group).

Indonesia has also great potential to become a production hub for EV batteries given the abundant nickel ore natural resources in the country. Many EV carmakers, namely from China, are keen to enter upstream in the supply chain for EVs and automotive batteries including the mining and refining of nickel ore, producing precursors and cathode materials.

Journeys to other geographies

Although Europe and ASEAN are the main markets in the internationalization path of Chinese EV carmakers, the main producers are also expanding into other relevant geographies.

In Central Asia, the Kazakhstan government, unveiled (on March 2023) that it reached an agreement [with Chery and ZEEKR] for the construction of EV plants for the production of Exeed and Geely car models, with a planned capacity of 80,000 finished vehicles.

It is noteworthy the sizable investment by BYD [Europe] (in partnership with Uzavtosanoat) in the Jizzakh region, in Uzbekistan, for an EV plant using initially the CKD method. Chinese firm Henan Suda signed a deal with Uzbekistan’s Energy Ministry to build upwards of 50,000 electric vehicle charging stations around the country by 2033.

In Latin America, thus far, Chinese EV carmakers have focused in Brazil and in Mexico. In Brazil, Chinese EV carmakers are already the EV market leaders, and they appear set to capitalize on the rapidly growing market for EVs in the country. EV sales in Brazil were up 145% in the first three months of 2024, according to the Brazilian Electric Vehicle Association, with BYD and Great Wall Motors leading the pack on EV sales in Brazil, the world’s sixth-largest auto market. Like the US and the EU, Brazil has raised tariffs on all imported EVs, which should reach 35% in 2026.

Great Wall and BYD have both pledged to build EV factories in the country. BYD estimates that its Camaçari complex (a former Ford cars plant) will be able to churn out 150,000 vehicles per year once it opens, while Great Wall’s plant in Iracemápolis (a former Mercedes-Benz cars plant) could produce 100,000 vehicles annually. Following its business model in China, BYD is trying to recreate an integrated supply chain in Brazil (and Chile), reportedly holding talks about taking over one of the country’s lithium producers.

BYD committed to make an EV plant in Central Mexico. SAIC also plans to build an EV plant in the country, to produce locally MG-branded vehicles. Jetour (in alliance with the LDR company), another Chinese EV automaker, also announced large investments in Mexico (in Aguascalientes and/or Guanajuato) for a dual assembly plant – it will produce both combustion vehicles (ICE) and EVs. Chery is also mentioned in the media as being engaged in discussions with Mexican authorities over the setting up of EV car assembly plants.

A report from the ‘Alliance for American Manufacturing’, released in February 2024, describes as “alarming” the Chinese focus on building plants in Mexico. “They can access the US by way of the more favourable tariffs [2.5%] under the USMCA. This strategy is, in effect, an effort to gain backdoor access to American consumers by circumventing existing policies that are keeping China’s autos out of the US market.” The Alliance expressed concern that “the introduction of cheap Chinese autos – which are so inexpensive because they are backed with the power and funding of the Chinese government – to the American market could end up being an extinction-level event for the US auto sector”. Reuters reported, on April 2024, that the Mexico’s federal government, under pressure from the US authorities, is keeping Chinese automakers at arm’s length by refusing to offer such incentives as low-cost public land or tax cuts for investment in EV production.

In the Middle East, in 2022 Enovate Motors, a Chinese EV start-up, announced it would make (in partnership with Saudi Sumou Holding) an EV plant in Saudi Arabia. On mid-2023 Saudi Arabia’s Ministry of Investment agreed with Chinese EV carmaker Human Horizons a mega-deal of $5.6 billion to collaborate on the development, manufacture and sale of vehicles. These investments in the new plants made by Chinese-based EV automakers in Saudi Arabia are expected to serve the surrounding region.

In India, BYD, which entered the Indian passenger vehicle market in 2021, currently offers two products in its India portfolio – Atto3 SUV and e6 MPV – which are imported and assembled at its plant in Chennai. However, on mid-2023, a proposal by BYD (in partnership with Hyderabad-based Megha Engineering and Infrastructures) to make another EV plant, in Hyderabad (the proposal included a plan to set up charging stations in India and build research and development and training centres) was refused by the Indian government on “security concerns with respect to Chinese investments in India”. More recently, the Indian government changed its approach. On March 2024, the new EV policy approved by Indian government, allows import duty concessions (a limited number of cars costing USD >35,000 will be subject to lower customs/import duty of 15% for five years) to be given to foreign companies setting up manufacturing units in the country with a minimum investment of USD 500 million. Clarifications were made by the Indian government that this new policy also applies to Chinese EV carmakers, but many of these Chinese EV corporations will remain at large given the serious tension arising from regional rivalry and borders conflicts.

Conclusion

Several 2021 Merics analysts’ predictions – that China would become a major automotive export hub, that Europe would be the main market for Chinese EV exporters, that the Chinese government would issue directives, put pressure and support Chinese and China-based foreign carmakers to export, that Chinese manufacturers would move up the EVs value chain, that Chinese companies’ overseas investments and partnerships would make them global [successful] competitors, that government subsidies for China-based manufacturers could distort global markets – became true.

The internationalization of Chinese EVs is global, albeit giving priority to markets with higher income and demand for EVs.

The internationalization of Chinese EVs is subject to political decisions at home and abroad, often influenced by geopolitical concerns.

In several cases, of which BYD is a good example, the integration of upstream stages in the EVs value chain (producing its own EV batteries and its components as well as refining the critical metals needed for EV batteries), creates bigger operating margins that provide greater price elasticity and makes Chinese EVs very competitive.

Internationalization of Chinese EVs will continue to be made on a dual track – via exports of certified models and via investments in local EV plants.

High(er) tariffs on imported EVs to protect domestic automotive industries – as is the case in the US, the EU, Brazil and Thailand – are likely to continue.

The impact of higher tariffs on imported EVs is not clear but it is likely to reduce [the pace of] exports of Chinese EV models of such relevant markets.

Although higher tariffs will make some Chinese EV carmakers (e.g., XPeng) hesitate to go ahead with planned EV plants in said protected markets, such investments likely will be a necessary cost to maintain access to some of those markets, namely in Europe.

In some markets where higher tariffs are but a tool arising from a clear political will of not allowing Chinese EV carmakers to enter the national market – as seems to be the case of the US and India – it is unlikely that Chinese EV will be successful in penetrating such markets; in some cases (US), commitments on investments in local EV plants will probably not be authorized.

Nonetheless, even with the recently announced imposition of US, EU and Brazil higher tariffs on EVs from China (and, in the case of the US, from 2030 also from Southeast Asia), a fast pace for the internationalization of Chinese EV carmakers is inevitable in every relevant market and hard times lie ahead for European, American, Japanese and Korean automakers.